No products in the cart.

Mastering Leadership in Finance: Strategies for Senior Executives

In today’s volatile financial markets, the difference between strategic success and organisational stagnation often comes down to the quality of leadership at the top. Managing directors in the financial sector are no longer merely responsible for operational oversight; they are expected to be visionary navigators of change, capable of steering their institutions through an increasingly complex web of global, regulatory, and technological challenges.

As the demands of the financial world evolve, so too must the competencies of those who lead it. Executive education has thus transformed from a luxury into a strategic imperative – especially for those who aim to stay ahead of the curve.The term “executive excellence” encapsulates more than just competence. It speaks to the continuous pursuit of mastery, adaptability, and strategic foresight.

The Executive Excellence: Online Course for Managing Directors in the Financial Sector is emblematic of this new standard. Far from being a generic leadership programme, it is a meticulously crafted curriculum that blends the nuances of corporate governance, financial risk management, digital transformation, and high-level decision-making into a cohesive learning experience. For senior executives who understand that stagnation equals obsolescence, this type of high-calibre training is not optional – it’s foundational.

Why Strategic Leadership Matters in Modern Finance

The financial sector has always been dynamic, but the velocity and complexity of change in recent years are unprecedented. From the rise of decentralised finance (DeFi) and AI-driven risk analytics to an ever-tightening regulatory environment, managing directors face a battlefield unlike any other. These changes demand more than just tactical expertise; they require strategic leadership capable of transforming uncertainty into opportunity.

Leadership in finance today is no longer defined solely by profit margins or shareholder value. Ethical governance, ESG compliance, and digital fluency have emerged as cornerstones of corporate stewardship. Senior executives must lead with integrity while understanding the implications of every decision across departments, stakeholders, and even geopolitical lines. This redefinition of leadership is why structured executive education matters more now than ever. A robust programme doesn’t just update your skills – it refines your strategic lens.

“To lead effectively in finance today means mastering both the mechanics of markets and the mindset of transformation.”

This quote embodies the core philosophy behind modern executive development. It’s not about reacting to change – it’s about anticipating it, influencing it, and guiding teams through it with clarity and confidence. A great example of such foresight can be found in specialised learning formats tailored for senior financial leaders. Among these, one online course for managing directors in the financial sector stands out by offering a curriculum that combines regulatory insight, strategic foresight, and leadership refinement. Rather than overwhelming participants with abstract theory, it focuses on immersive, scenario-based development that mirrors the kinds of high-stakes challenges executives face in their daily reality.

Core Competencies Every Financial Executive Must Develop

While technical knowledge remains crucial, modern managing directors must now wear many hats – strategist, innovator, regulator, communicator. This multidimensional role requires a focused development of key competencies that go far beyond the traditional scope of financial oversight. First and foremost, strategic thinking has become indispensable. This means not only setting long-term objectives but aligning them with market realities, risk assessments, and the shifting expectations of both customers and regulators.

Courses like Executive Excellence place strong emphasis on systems thinking, scenario planning, and macroeconomic forecasting – skills that help executives move from short-term firefighting to long-term value creation.Equally important is digital fluency. In an era where blockchain technologies, AI algorithms, and cloud-based infrastructures are transforming the financial services ecosystem, ignorance of tech is no longer acceptable at the executive level. Programmes that combine financial leadership with digital transformation modules empower directors to lead not just with confidence but with competence. A brief but essential list of core competencies often emphasised in executive programmes includes:

- Strategic risk management

- Corporate governance and ethics

- Stakeholder engagement and communication

- Data-driven decision-making

- Organisational transformation and agility

These are not just buzzwords—they are survival skills in today’s high-stakes financial environment. Without them, even the most experienced managing director may find themselves outpaced by disruption or blindsided by misjudged market shifts.

Navigating Regulatory Complexity with Confidence

Regulatory compliance in the financial sector is no longer a back-office concern. It has evolved into a central leadership priority that demands comprehensive understanding and proactive engagement from managing directors. As financial institutions face intensifying scrutiny across international markets, it is the executive team’s responsibility to foster a culture of compliance while aligning it with strategic growth initiatives. This delicate balance requires in-depth knowledge of both the letter and spirit of regulations—a skillset that is often overlooked in conventional leadership development tracks.

Executive training programmes like Executive Excellence bridge this gap by offering participants an immersive understanding of regulatory frameworks such as Basel III/IV, MiFID II, Dodd-Frank, and GDPR. But more importantly, they emphasise practical application. Case studies drawn from real enforcement actions and regulatory disputes challenge learners to think critically, assess legal ramifications, and develop internal controls that go beyond box-ticking exercises. Through this, executives are better equipped to create systems that embed compliance into the very fabric of their organisations, ensuring sustainability and accountability.

The ability to interpret, implement, and communicate regulatory changes across departments isn’t just a skill – it’s a strategic asset. In large institutions, the cost of non-compliance is measured not just in fines, but in reputational damage and lost market trust. Programmes that prioritise real-world simulation such as regulatory impact assessments or cross-border compliance planning – ensure that managing directors become not just policy enforcers, but regulatory leaders who inspire institutional integrity from the top down.

The Competitive Advantage of Lifelong Learning

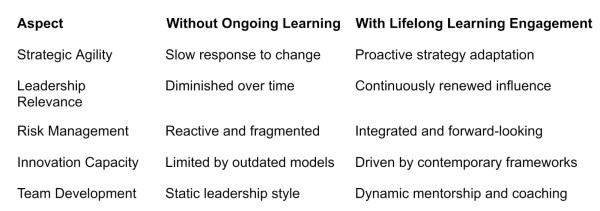

In the fast-paced world of finance, static knowledge is obsolete knowledge. For managing directors, staying ahead of the curve means engaging in continuous learning – structured, relevant, and tailored to the evolving landscape. Lifelong learning is no longer a personal aspiration; it is a business imperative. Those at the helm must not only upgrade their technical acumen but also cultivate adaptive thinking to respond to shifting global dynamics.One of the most compelling aspects of the Executive Excellence: Online Course for Managing Directors in the Financial Sector is its flexibility and real-time relevance. Unlike traditional executive programmes that may be rigid or outdated, this course integrates ongoing market analysis, industry expert insights, and scenario-based updates to ensure that learning stays aligned with current challenges. Moreover, the online format accommodates the unpredictable schedules of senior executives, offering access without sacrificing depth or engagement. Let’s consider a comparative look at how lifelong learning advantages manifest in executive performance:

This comparison underscores the vital role of structured, continuous education. It is the bedrock upon which modern executives build resilience – not just for themselves, but for the institutions they lead. The right course doesn’t just teach, it transforms.

Cultivating Executive Presence and Influence

In boardrooms, Influence and Influence is often what distinguishes a good leader from a great one. It the ability to command attention, convey vision, and inspire confidence – not through theatrics, but through grounded authority encompasses strategic clarity. Managing directors must master the art of communication, influence, and leadership presence if they are to galvanise teams and align diverse interests around bold initiatives.The Executive Excellence: Online Course for Managing Directors in the Financial Sector recognises executive presence as a trainable skill, not a fixed trait. Through modules focused on advanced negotiation techniques, cross-cultural communication, and conflict resolution, the course equips leaders with tools to elevate their interactions. Participants learn how to craft persuasive narratives for investors, articulate long-term strategies to boards, and lead with empathy during internal transformations. More than just soft skills, these capabilities are crucial in shaping internal culture and external perceptions, both of which directly impact financial performance.

Additionally, the programme supports the development of emotional intelligence (EQ) as a central pillar of leadership. In a sector driven by numbers, the ability to sense, understand, and manage human emotions can feel secondary. But as studies increasingly show, high-EQ leaders outperform their peers in decision-making, crisis management, and team engagement. By helping executives build this competency, the course fosters leadership that is not only analytically sharp but also deeply human— an increasingly rare combination in the digital age.

Driving Organisational Change from the Top

True transformation in financial institutions does not happen from the middle out, it happens from the top down. Managing directors are the catalysts of change, and their ability to lead strategic evolution determines whether their organisations thrive, survive, or fail. In an industry undergoing constant disruption, change management is not an occasional undertaking but a continuous process that must be embedded in executive strategy. This is why programmes like Executive Excellence dedicate entire modules to organisational transformation. Participants are exposed to frameworks like Kotter’s 8-Step Change Model and the McKinsey 7S Framework, not as academic theories, but as practical tools for initiating and managing enterprise-wide change. They learn how to build internal coalitions, assess readiness for transformation, and mitigate resistance from within.

Crucially, these learnings are contextualised within the realities of banking, insurance, fintech, and investment management, making them immediately applicable. Change leadership also involves navigating political and cultural landscapes. Financial institutions often have legacy systems, entrenched hierarchies, and regulatory constraints that can stall innovation. The ability to balance tradition with transformation—preserving what works while discarding what no longer serves—is an executive art form. By empowering managing directors with the insights and strategies to lead this balancing act, the course helps ensure that transformation efforts are not just launched but sustained.

What Sets Exceptional Financial Leaders Apart

Exceptional leaders in the financial sector share common traits, but what truly sets them apart is how they apply these traits consistently across crises, innovations, and evolutions. They do not merely respond to their environment—they shape it. The journey toward becoming such a leader is continuous, deliberate, and deeply personal.

It requires not only intellect and experience but also the humility to grow and the courage to change. Executive Excellence: Online Course for Managing Directors in the Financial Sector offers this journey in a format that is both rigorous and flexible, intellectually demanding yet accessible. It is more than a course—it is an executive evolution. In a world where the cost of poor leadership can ripple across markets and economies, investing in this kind of growth is not a luxury; it is a necessity.

Also read: How Senior Leadership Training Drives Organisational Resilience

Post Views: 171

Tags: Top Picks

Add comment