No products in the cart.

Teaching children financial literacy

PW invited parents of DPS, Sector 45, Gurgaon to share how they teach children financial planning and literacy

Like most parents, we give our daughter Sanaa (class IX) pocket money every month. Although we don’t control her spending, we advise her to spend it purposefully. Of late, our weekend outings include a trip to a book shop where she spends her pocket money. We also encourage Sanaa to save by contributing 50 percent towards any item she purchases for herself. We are now involving her in bigger decisions like helping to budget for our annual holiday. Sanaa is gradually learning to forego immediate gratification for bigger rewards later and also learning to value money and spending prudently” — Roohi Trehan, entrepreneur, Gurugram

“We encouraged our son Sakshin (class VI) from age five to buy groceries from the neighbourhood store. This has introduced him to the world of money. We also explain to him how we invest money and manage risks, and the outcome of bad investment decisions. Sakshin currently has a bank account in which gift money received from his grandparents, uncles and aunts is deposited, apart from prize money. He keeps track of all transactions so he can purchase things he fancies. This has enabled him to understand the importance of managing expenses within a budget” — Suvasis Ghosh, head of client growth and development, SAM & Co, Gurugram

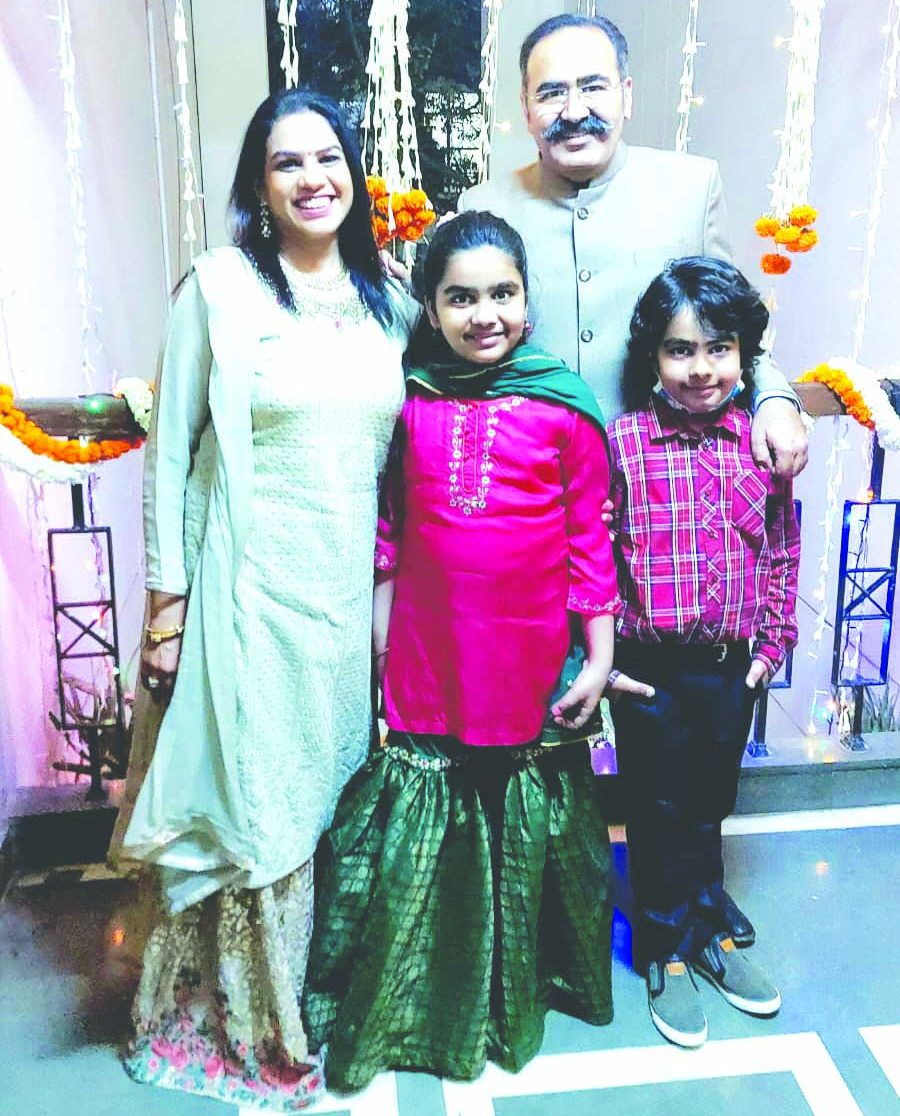

“In Punjabi families like ours, shagun ke lifafe (packets of cash) are commonly exchanged between elders and children for safekeeping with parents. However when our son Ojsya (class IX) turned ten, he demanded his gift money. Although initially we agreed, we realised he needed to learn some financial planning and literacy. We also agreed that we would contribute an equivalent amount of his total gift money for investing in equities of his choice. Soon our daughter Advikaa (class V) also followed suit. Both are currently generating a return of 20 percent on their investment and improving their maths and financial literacy” — Sachin Chugh, partner, Singhi Chugh & Kumar, Chartered Accountants

“In the pandemic years, everything was just a click away for my children Dhanika (11) and Bheeshajam (9) — from ordering groceries to paying bills and buying school stationery. I make them understand how money is deducted from our bank accounts with every click. When they became eligible for pocket money, they started saving a small percentage of their allowance to purchase what they fancied for themselves. I have seen their initial irritation turn into patience and smiles of satisfaction. With the right guidance and patience, children can quickly understand the value of money” — Dr. Vinita Malik, dentist, Smileeworks, Gurugram.

Also read: Teaching children financial literacy for a lifetime of financial wellbeing

Add comment